“I Was Losing Pieces of My Childhood:” a Former Child Farmworker Urges Action to End Child Labor in a Speech to Be Remembered

By Reid Maki, NCL Director of Child Labor Advocacy & Coordinator of the Child Labor Coalition

The recent 6th Global Conference on the Elimination of Child Labour included high-ranking officials from over 100 governments, the ILO, trade groups, and employer groups. I heard many speeches from child labor experts with decades of experience, but former NCL intern Jacqueline Aguilar, only 23 and a recent college graduate, gave by far the most compelling and poignant remarks. In 2023, Jacky interned for me at the Child Labor Coalition, a program of the National Consumers League. She came to us through a remarkable program for former Migrant Head Start students led by the National Migrant and Seasonal Head Start Association, a member of the Child Labor Coalition.

Jacky spoke on a panel with a half-dozen government officials and a trade unionist. She recalled her experiences in the United States as a child laborer in agriculture. Members of the Child Labor Coalition are concerned that, in any given year, there may be as many as 300,000 minors working in agriculture. They work legally at tasks most adults cannot do because of gaps in child labor law that apply to agriculture. These exemptions allow children to work unlimited hours in the fields (if they aren’t missing school) beginning at the age of 12.

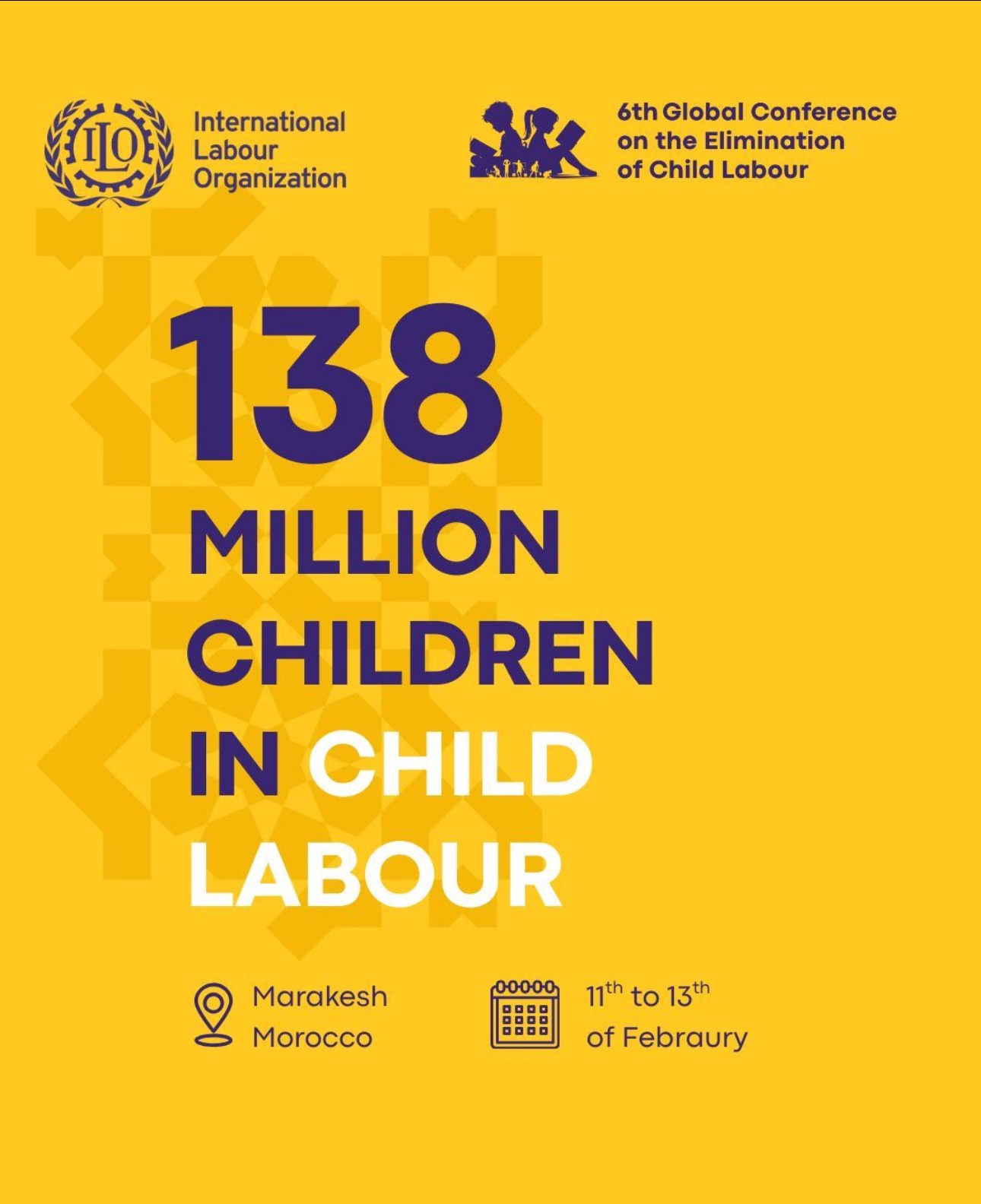

Jacky spoke from the heart about the impact child labor has had on her life and those of her peers from migrant families. Her remarks reminded us of why we were at the conference and impressed the attendees that we must act urgently to protect the 138 million children trapped in child labor.

Jacky started: “When people hear ‘child labor,’ they imagine something far away. A different country. A different life. But I am standing here to tell you it happened. In our communities. In our fields.”

“My parents worked in the fields every single day to provide for us,” recalled Jacky. “I remember waiting by the door as a little girl for my dad to come home. When he put his hand on my cheek, I would feel how rough it was: cracked, dry, hardened by the earth. I used to wonder why his hands felt like that. Now I know. Those hands were not meant to be that way. They were shaped by survival.”

“At 11 years old, I stepped into those same fields. 11,” she continued. “While other kids were worrying about homework or sleepovers, I was waking up at 4:00 in the morning. It was still dark outside…By 5:00 a.m., I was in the lettuce rows. The fields were endless. My hands wrapped around a hoe that felt too heavy for my body. The metal burned my palms. Blisters formed and broke. My feet ached from standing for hours. The morning dew soaked through my shoes, and the cold crawled up my legs.”

“There was no one asking how old I was. No one asking if I was tired. No one asking if I was okay. We had 30 minutes for lunch. 30 minutes sitting in the dirt. No cold water. No shade. Just the understanding that we needed to move faster. I wasn’t building character. I was losing pieces of my childhood.”

Like many farmworker families, Jacky’s was touched by cancer. “My father was diagnosed with lung cancer,” she said. “He had been in agriculture since he was seventeen years old,” she recalled. “I think about the pesticides he inhaled. The dust that settled deep into his lungs. The chemicals that were part of his everyday air. My mother’s body gave out, too. Years of lifting heavy sacks of potatoes tore her shoulder until she couldn’t lift them anymore. I watched my parents sacrifice their health for us. And when my father had to move three hours away for treatment, I stayed behind. I was still in school. But I worked the potato harvest so we could survive, and I could help support my family. “

Jacky recalled one day in particular: “One morning, it started snowing while we were in the field, and the snow collected on the dirt, on the crops, on our shoulders. My fingers went numb. My socks were soaked. I couldn’t feel my toes. I remember standing there, staring at the ground, silently begging for someone, anyone, to say, ‘Go home.” That’s enough.’ But no one said anything. And that silence… it teaches you something. It teaches you that your pain is normal. That your exhaustion is expected. That your childhood is negotiable. I didn’t lose my childhood in one moment. I lost it in early mornings. In blistered hands. In missed school events. In falling asleep over homework because my body couldn’t take anymore.”

Jacky wasn’t alone. She saw other farmworker children suffer. “I watched classmates disappear from school. Smart kids. Funny. Full of light. They didn’t transfer schools. They transferred to full-time labor. And no one called it a crisis,” she recalled. “No child should have to choose between education and survival. No child should feel responsible for keeping their family afloat. No child should stand in freezing snow waiting for permission to stop working.”

Speaking before an audience of government officials from all over the world, Jacky implored them to do more to end child labor: “To our ministers, policymakers, and public leaders, I am asking you to see us. Strengthen protections for children. A child in a field deserves the same protection as a child anywhere else. Enforce the laws. Visit the fields. Ensure there is clean water, real breaks, and protection from harmful chemicals. Support families with living wages, healthcare, and financial stability so children are not pushed into labor out of desperation. Train schools to recognize working children not as lazy or distracted but as exhausted. And include survivors in your decisions. We know where the system fails because we experienced the failure.”

“I am proud of my parents. I am proud of where I come from. But I should not have had to grow up that fast,” said Jacky. “There are children, right now, standing in rows of crops before the sun rises. Their hands are blistering. Their backs are aching. Their childhood is slipping away quietly. And most people will never know their names. Please do not let their silence continue because child labor does not just take childhoods. It takes futures. And we cannot afford to keep losing them. This happened. I survived it. And I’m not going to whisper about it.”

In three decades of advocacy and four Global Child Labor conferences, I’ve never heard a speech more eloquent or powerful.

Jacky speaks for children in child labor everywhere—not just the 300,000 children who work in agriculture. In recent years, thousands of unaccompanied minors, have come to work in the U.S. Many ended up working in auto parts factories, the graveyard shifts in meatpacking facilities, or late nights at fast food restaurants. Yet children working in the U.S. are a small fraction of the global reality: 138 million children are engaged in labor worldwide. Jackie Aguilar’s story gives a voice to all of them.

Jacqueline Aguilar is a recent graduate of Adams State University in Colorado, where she lives and works. Jacky interned for the Child Labor Coalition in the summer of 2023 at the National Consumers League.

In Marrakech, Morocco, on Wednesday morning, the 6th Global Conference on the Elimination of Child Labour opened at the Palais des Congrès to a palpable air of excitement.

In Marrakech, Morocco, on Wednesday morning, the 6th Global Conference on the Elimination of Child Labour opened at the Palais des Congrès to a palpable air of excitement.