By, Eden Iscil, Senior Public Policy Manager

Following the growth of online sports betting and increased data documenting associated harms, NCL has released its first report on sports betting companies’ advertising practices. The report focuses on sports betting apps and how they use smartphone notifications to advertise to consumers. After concluding its study, NCL believes that sports betting companies’ use of push notifications for marketing purposes may violate federal law as a prohibited unfair practice. The full report is available here.

Why does this matter?

It sounds benign at first, but using push notifications to advertise an addictive product is a rather aggressive practice. Notifications on your phone will demand your attention whether you are on the street, at work, at home, or in bed. From the minute you wake up to the second you fall asleep, app notifications can be hard to dodge once they get going. Should a corporation really be able to use that channel to market its products?

Sports betting is not a typical product or service. These companies are not selling shoes or T-shirts. They are aggressively advertising their platforms for gambling, an activity that has well-documented addictive and harmful effects, from increased rates of suicide and intimate partner violence to an elevated risk of bankruptcy.

The U.S. government (rightfully) considered the advertising of cigarettes over the radio to be too extreme and banned those marketing practices decades ago. Now imagine if a tobacco company sends a text every day, multiple times a day, to encourage you to smoke their cigarettes. That is basically what sports betting apps are doing.

Findings

Over the course of four weeks, NCL collected more than 100 notifications from the three biggest sports betting apps—FanDuel, Draft Kings, and BetMGM. We found that, overall, 93% of the notifications contained advertising material. 62% contained what we refer to as “bet pushes,” or language urging the user to open the app and place a bet, often explicitly with words like “bet now.” Fifty percent of the notifications contained promotional offers (bonuses, bonus bets, and odds boosts), a practice which would be largely prohibited by the NCL-endorsed legislation in Congress known as the SAFE Bet Act. (These rates varied among the three companies.) More detailed findings on the content of the notifications can be found in the full report.

We also noted additional practices from the apps that raise concerns beyond the content of the notifications. FanDuel, which is the biggest sports betting platform by market share, automatically grants itself permission to send users notifications once it has been downloaded on an iPhone. This is especially worrying given the general expectation among users that apps will ask for consent before sending notifications. The other two apps downloaded for the study, Draft Kings and BetMGM, did ask for permission before beginning to send notifications, but did not disclose the extensive amount of advertising that would follow. None of the three apps’ native settings on iPhone allow the user to disable advertising notifications.

If a sports betting company wants to send a consumer marketing text messages, federal law requires it to receive express written consent first. If it wants to send marketing emails, it must provide a way to unsubscribe within the email. But when it sends marketing push notifications—more customizable and information-dense than an SMS, while more visible than an email—it does neither of those things, delivering marketing notifications without express written consent and without an embedded mechanism to opt out of the practice.

Considerations for regulators

Consumer protection agencies already have the legal authority to act. The Federal Trade Commission (FTC) should take a serious look at how these apps are using push notifications to advertise to consumers, many of whom are likely to have a gambling disorder. The FTC has extensive resources to tackle this issue, including its ability to prohibit unfair and deceptive acts or practices (15 USC §§ 45, 57a) and its broad authority to investigate market practices (15 USC § 46).

After concluding its study, NCL believes that the aggressive use of push notification advertising by sports betting apps’ may be an unfair practice prohibited by the FTC Act.

Substantial injury

The chance for substantial injury to consumers is a real and documented threat. Microsoft has published data showing that personalized push notifications can increase user engagement for mobile apps by up to 300%.[1] One company’s analysis of 63 million app users found that users receiving notifications at least once a day had 820% higher app retention rates compared to users receiving zero notifications.[2] Another firm’s analysis reported that push notifications boost average app sessions per user by 182%, purchases per user by 116%, and average user lifetimes by 73%.[3] That is an extremely high level of attention-capture for any product, but especially one as addictive (and potentially harmful) as sports betting.

Consider the impact of these advertising practices on a user who suffers from a gambling disorder. Research has shown:

- 19% of individuals with a gambling disorder had considered suicide in the past year compared to 4.1% of the general population.[4]

- 7% attempted suicide compared to 0.6% of the wider population.

- One study found a 10% increase in intimate partner violence rates in households engaged in sports betting after their preferred team lost.[5]

- In states that legalized online sports betting, bankruptcy filings increased by as much as 25-30% compared to pre-legalization rates.[6]

Sports betting apps are using a highly effective marketing practice to push a product that has strong links to substantial bodily and financial injury.

Not reasonably avoidable

The three sports betting apps do not clearly disclose that allowing notifications will result in the receipt of advertising notifications. FanDuel did not ask for permission before sending notifications. BetMGM did not first disclose that it would send advertisements over push notifications when requesting permission for notifications. BetMGM used the standard iPhone notification request language: “‘BetMGM Sports’ Would Like to Send You Notifications[.] Notifications may include alerts, sounds, and icon badges. These can be configured in Settings.” Draft Kings included the following language before requesting permission to send notifications: “Stay in the Know[.] Make your betting experience even better. Turn on notifications, and we’ll keep you in the know with exclusive offers like deposit matches, bonus bets, and more.” From this language, the consumer would not know that approximately 98% of the notifications they are consenting to will contain advertising, or that roughly 86% will contain bet pushes (language directly aimed at inducing betting, often with the words “bet now”). An individual cannot reasonably avoid something they are not made aware of.

If a consumer decides they want to opt out of advertising notifications, the apps do not natively make it possible to do so (at least for the versions available on iOS at the time of the study). None of the in-app settings for FanDuel, Draft Kings, or BetMGM allow users to disable advertising push notifications, despite providing controls for other advertising channels, such as email. BetMGM has a checkbox for “individual offers” delivered to the user’s “phone,” but BetMGM customer support clarified that it applies only to phone calls, not app notifications. iPhone settings allow users to disable notifications entirely for an app, but doing so would block important notifications that may otherwise be desired, like notifications of new login attempts or cash balance withdrawals.

In short, a consumer looking to avoid advertising notifications would first have to be aware of the practice (which the apps do not clearly disclose), find the settings to disable all notifications for the app, and then decide between continuing to receive the invasive marketing or potentially missing critical account security alerts. The companies do not design or implement their practices to be reasonably avoidable.

Not outweighed by countervailing benefits

The use of push notifications by sports betting apps to advertise creates a high risk of substantial injury for consumers for the sole purpose of increasing the companies’ profits. NCL is not aware of any credible research documenting a countervailing benefit from consumers experiencing regular exposure to sports betting advertising.

Opportunity for large-scale research

The FTC has investigative authority under § 6(b) of the FTC Act and access to greater resources than NCL. The agency could fully document and publish its findings on the sports betting industry’s use of push notifications for advertising purposes, providing much-needed insight into current business practices and better informing policy work at the Commission, in Congress, and in the states.

NCL’s full report on sports betting apps’ advertising notifications can be found here.

[1] “Push notifications: Help or hindrance,” Microsoft Azure, March 3, 2016. https://azure.microsoft.com/en-us/blog/mobile-push-notifications-help-or-hindrance/

[2] “How Push Notifications Impact Mobile App Retention Rates,” Airship, 2019. https://grow.urbanairship.com/rs/313-QPJ-195/images/airship-how-push-notifications-impact-mobile-app-retention-rates.pdf

[3] “Why Push Notifications Are Important to Your Cross-Channel Strategy,” Braze, June 10, 2024. https://www.braze.com/resources/articles/why-push-notifications-are-important-to-your-cross-channel-strategy

[4] Vijayakumar and Vijayakumar. “Online gambling and suicide: Gambling with lives,” Indian Journal of Psychiatry, January 13, 2023. https://pmc.ncbi.nlm.nih.gov/articles/PMC9983450/

[5] Matsuzawa and Arnesen. “Sports Betting Legalization Amplifies Emotional Cues & Intimate Partner Violence,” October 30, 2024. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4938642

[6] Hollenbeck, Larsen, and Proserpio. “The Financial Consequences of Legalized Sports Gambling,” October 23, 2024. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4903302

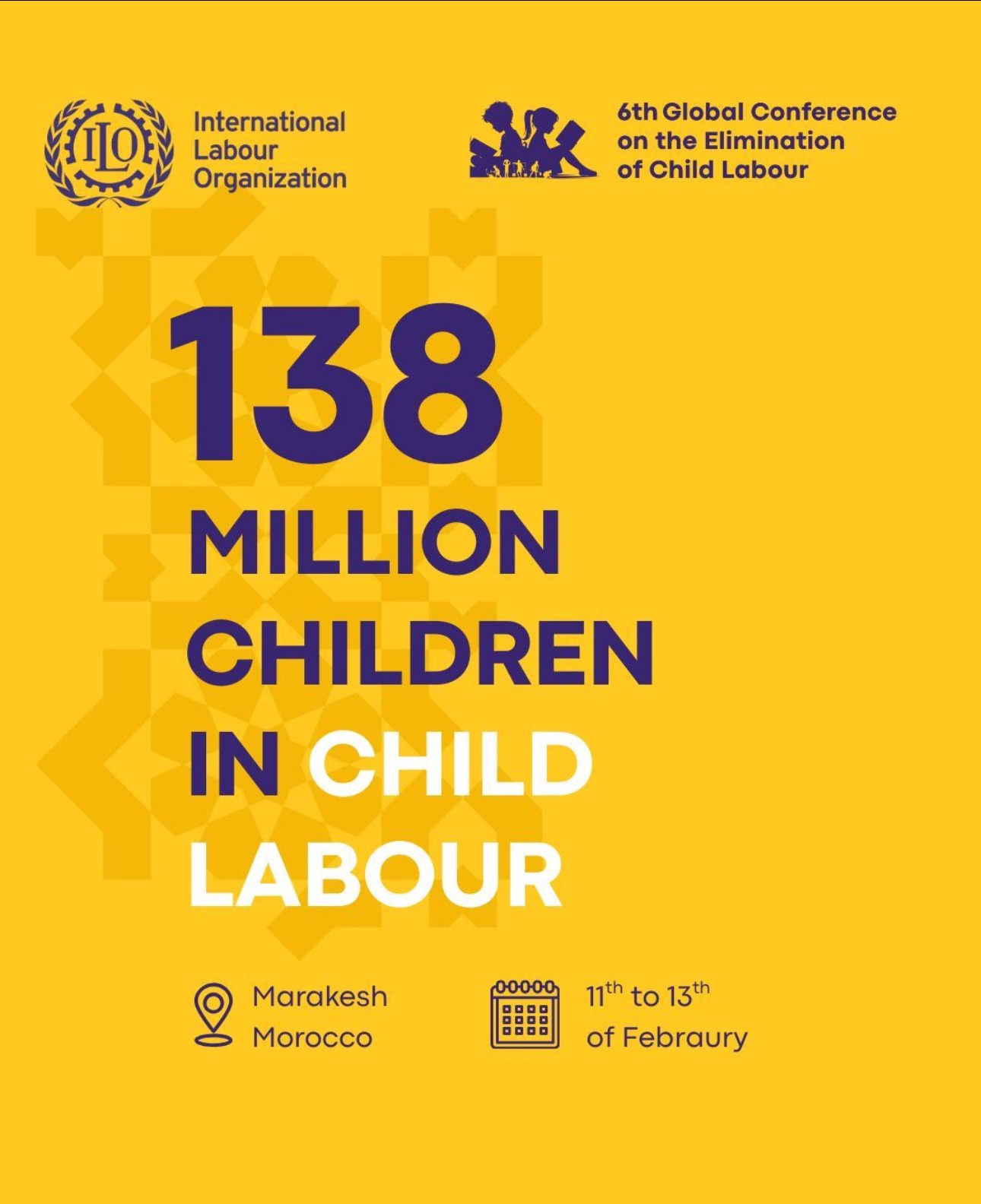

In Marrakech, Morocco, on Wednesday morning, the 6th Global Conference on the Elimination of Child Labour opened at the Palais des Congrès to a palpable air of excitement.

In Marrakech, Morocco, on Wednesday morning, the 6th Global Conference on the Elimination of Child Labour opened at the Palais des Congrès to a palpable air of excitement.