Inside the 2026 International Consumer Product Safety and Health Organization (ICPHSO) Conference: Where Consumer Safety Meets Accountability

By Sally Greenberg, NCL CEO

Did you know that there are 1 billion pencils in circulation in the United States, including those ubiquitous NUMBER 2 pencils required to take the SAT exam? Pencil manufacturers even have their own industry association dedicated to safety, environmental responsibility, affordability, and compliance with recognized standards. I didn’t know that either.

But that is the kind of thing you learn at the annual International Consumer Product Safety and Health Organization (ICPHSO) conference, which I’m attending this week in Orlando. More than 700 participants are here, representing manufacturers, government regulators, supply chain and recall specialists, inventory and IT operations teams, and numerous law firms that specialize in regulatory compliance.

This is a must-attend conference for manufacturers of consumer goods; it’s also a meeting where parents whose children have suffered injuries or even killed by dangerous products, such as tiny batteries or water-absorbing beads that expand if children swallow them.

Daniel Greene, who leads auto and product safety work at the National Consumers League, and I have spent the last few days with many of these companies, learning how they ensure the safety of their products. There are many tools and resources available to help manufacturers comply with the law. We also met with a firm that specializes in designing accessibility into consumer products, so they are usable by people with a wide range of disabilities.

I’ve learned some interesting things at this conference about the importance of consumer advocacy:

- The Consumer Product Safety Improvement Act of 2008, enacted at the urging of consumer advocates after a child died from ingesting a toy containing lethal levels of lead, now requires far more rigorous safety testing before products enter the marketplace. One arts and crafts manufacturer told me the law has increased compliance demands but ultimately leads to much safer products.

- There are highly sophisticated services available to help companies manage product recalls, comply with complex regulations, interpret voluntary standards, and do outreach to consumers.

- I learned that the legal business for compliance with safety regulations is booming.

- Despite progress, children and adults continue to suffer preventable injuries from hazardous products, including bath seats, bed rails, window blinds, tip-over furniture, poorly made bike and motorcycle helmets, and table saws.

- Not surprisingly, the table saw industry was not present. With one notable exception, saw manufacturers continue to resist adopting safety technology that has been available since 2001. I had an infuriating conversation about table saw safety with someone who worked for a major retailer. She spouted all the usual verbiage about the expense of fixing table saws that inflict 10 amputations a day, overlooking the fact that over the past 25 years, hundreds of thousands of innocent consumers and workers have suffered mangled hands and lost fingers that could have been saved had the industry done the right thing from the start.

That said, many good things come out of this conference. We were joined by consumer groups, including Consumer Reports, Consumer Federation of America, SafeKids, and Nancy Cowles, founder of Kids In Danger (KID). We are vastly outnumbered by the companies here, but we play an essential role in advocating for consumer safety. Many people and families who have experienced terrible injuries with products come to the conference in force, sharing powerful stories and urging industries to fix their products.

Thanks to the ICPHSO leaders, including Mark Schoem and David Kossoff, the organization’s director and president, and their teams, for putting together a critically important event for consumer safety and ensuring that the consumer voice remains part of the conversation.

From left to right: Sally Greenberg; Daniel Greene; Sean McCurry, Accessibility Specialist at TransPerfect

Sally Greenberg & Don Mays, former colleague at Consumer Reports

Sally Greenberg & Bob Eckert, former Mattel CEO

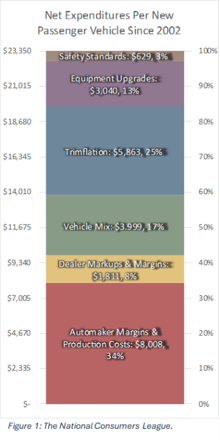

“Families don’t have to choose between safety, fuel efficiency, and vehicle affordability, and the data proves it,” said

“Families don’t have to choose between safety, fuel efficiency, and vehicle affordability, and the data proves it,” said