Top Ten Scams Report: Phishing and Spoofing Scams Nearly Double in 2025 as AI-Powered Fraud Surges

Media Contact: Lisa McDonald, Vice President of Communications, 202-207-2829

Washington, DC – Phishing and spoofing scams soared by 85.6% over the past year, doubling median losses from $1,000 to $2,060, according to the National Consumers League’s Fraud.org Top Ten Scams of 2025 report. Of 1,376 consumer complaints analyzed, investment scams caused the highest median loss at $30,000.

“Given widespread evidence that scammers are increasingly using artificial intelligence tools to craft better pitches, the rise in phishing complaints is particularly concerning,” said NCL Vice President of Public Policy, Telecommunications, and Fraud John Breyault. “AI enables criminals to quickly generate highly realistic phishing emails and clone voices, making scams more convincing and allowing them to reach more targets than before. This underscores the need for consumers to verify information before trusting it.”

The changing landscape is evident in attack methods as well. In a dramatic shift, web-based contact has overtaken phone scams as the primary attack vector, with 48% of victims reporting their first interaction with scammers occurred online—marking the end of the robocall era’s dominance.

The Top Ten Scams categories reported to Fraud.org in 2025 were:

- Phishing/Spoofing

Emails pretending to be from a well-known source ask consumers to enter or confirm personal information.

- Internet: General Merchandise

Goods purchased are either never delivered or misrepresented.

- Prizes/Sweepstakes/Free Gifts

Requests for payment to claim fictitious prizes, lottery winnings, or gifts.

- Investment: Other (including cryptocurrency)

Consumers are tricked into paying money for bogus cryptocurrency investments.

- Advance Fee Loans, Credit Arrangers

False promises of business or personal loans, even if credit is bad, for a fee upfront.

- Fake Check Scams

Consumers are asked to cash fraudulent checks and then send the proceeds to a scammer before the check clears.

- Friendship & Sweetheart Swindles

A con artist nurtures an online relationship, builds trust, and convinces victims to send money.

- Family/Friend Imposters

A scammer calls or emails, claiming that a friend or family member is in distress (in jail, in the hospital, etc.) and urgently needs funds to help.

- Home Repair

Fraud involving contractors or repair services that take payment upfront, perform poor or no work, or disappear before completing promised repairs.

- Credit Repair

Fraud involving companies that promise to fix or improve credit scores for a fee, often using illegal or misleading tactics and failing to deliver real results.

The National Consumers League’s Top Ten Scams report analyzes 1,376 complaints submitted to Fraud.org in 2025. These complaints are self-reported and do not constitute a nationally representative sample of fraud victims. NCL shares complaint data with a network of law enforcement and consumer protection partners, who combine it with other data sources to identify fraud trends and support enforcement actions.

###

About the National Consumers League (NCL)

The National Consumers League, founded in 1899, is America’s pioneer consumer organization. Our mission is to protect and promote social and economic justice for consumers and workers in the United States and abroad. For more information, visit www.nclnet.org.

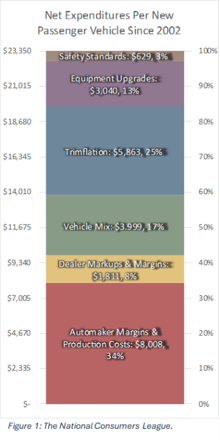

“Families don’t have to choose between safety, fuel efficiency, and vehicle affordability, and the data proves it,” said

“Families don’t have to choose between safety, fuel efficiency, and vehicle affordability, and the data proves it,” said